Are You Saving Enough for Retirement?

Key Takeaways:

- The savings gap - what people have saved for retirement vs what they need - is increasing.

- While it's ideal to start saving with your first job, it's never too late to begin saving for retirement.

- Alternative investments, including the self-directed IRA, strengthen a portfolio through diversification.

- Short Notes offer the opportunity to earn high-yield, fixed-rate passive income without the responsibilities of direct property ownership.

Advancements in science and medicine are allowing people to live longer, but many find that their retirement savings fall short of what’s needed to support them through these extended years. When is the best time to start saving for retirement?

Ideally, the answer is "as early as possible," but it’s never too late to begin. We'll guide you in determining your ideal retirement savings target, factoring in key variables and best practices.

Join us as we uncover how to best plan ahead for a financially secure retirement!

What is Retirement?

Retirement occurs when being part of the workforce is in your rearview mirror. In the United States, most people look at turning 65 as the golden age to stop working and begin enjoying whatever they have planned for their senior years.

The age at which you can receive full Social Security benefits depends on your state, typically at 66 or 67. However, you can start collecting early retirement benefits as early as age 62, though this will provide only 40% of your pre-retirement income. Alternatively, you can delay collecting benefits until age 70 to receive the maximum payout.

Careful planning is a must. Saving and investing for retirement is not enough —you must have a firm understanding of your future expenses. This will help establish that magic retirement savings number.

There are three common retirement savings methods, and these are:

- Employer-sponsored retirement plans such as the 401(k)

- Retirement savings, including investments

- Social Security retirement benefits

We'll touch on these, discuss how to determine your retirement needs and look at benchmarks. First, let's consider what you'll need to save for retirement.

What's the Magic Number for Retirement Savings?

The best time to start saving for retirement is when you get your first job. Just over 20% of American teens, aged 16 to 19, are working in some capacity and hopefully saving for retirement. Planning this early means these young people have time to watch their investments grow. It's never too early to start planning for retirement, but it's also never too late - it will just require more focused strategies.

Adult responsibilities can be a lot. With student loans, trying to save for a house, working out how to pay for your children's college education, and unexpected expenses on top of regular bills, it's easy to set retirement plans on the back burner. And when you're young, it's natural to think that leaving the workforce is a long way off. But, trust us, one day, it will feel like you've blinked and suddenly you're 65. Now is the moment to take a measure of where you are financially and where you want to be, and take the steps to get there.

Benchmarks or rules of thumb can be helpful. In fact, financial firms often publish information about what savings at different ages should look like in relation to incomes. These guides can help you quickly gauge where you sit, but you still need a comprehensive plan to assist you in reaching your retirement goals.

There are many factors that need to be considered when saving for retirement, and that's why careful planning is a must. These include:

- How early you begin saving

- Inflation

- Market volatility

- Healthcare costs

- Long-term care needs

- Lifestyle

- Diversification

- Taxes

- Social Security

- Retirement age

Age-by-Age Guide to Saving for Retirement

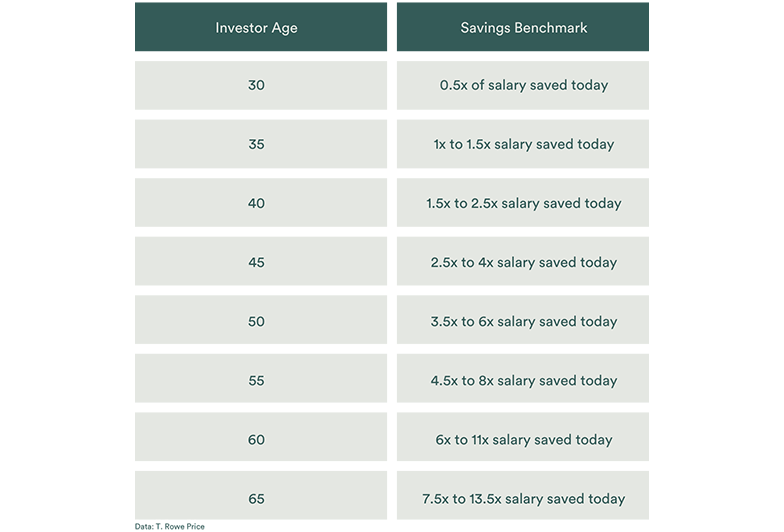

There are no cookie-cutter or one-size-fits-all retirement savings benchmarks. The amount of resources and the answer to "How long will retirement savings last?" depend on factors such as age, income, lifestyle, etc. However, a benchmark is still a handy tool, and the list below from global investment firm T. Rowe Price shows savings goals based on age.

Median Retirement Savings by Age

The savings gap is the difference between what people have saved for retirement and what they need, and the big picture is concerning. The table below, which breaks down the median retirement savings by age, shows that the median retirement savings is only $87,000, which is obviously far below what anyone would consider an adequate nest egg.

The $200,000 median retirement savings for the 65-74 age group is pretty dismal if you consider that this amounts to $10,000 a year to live on. How long will retirement savings last with these numbers? Not long at all.

The number of employer-sponsored pension plans has declined during the past few decades, resulting in smaller savings. Social security will continue to feel this effect as Americans rely on it more heavily to make ends meet.

People tend to underestimate their retirement savings magic number because they fail to account for how long they will live and consider that their healthcare needs will increase as they age. A recent survey shows that $1.46 million is the ideal retirement savings target, up from $1.27 million the previous year. So how do you get there?

How to Increase Your Retirement Savings

The best time to begin saving and investing for retirement is when you get your first job. The second best time is now! It's never too late. Here are some tips on how you can maximize your retirement savings.

- There is no time like the present, so start saving today. The sooner you begin, the more interest you will earn.

- Contribute to your 401(k) or workplace retirement plan. Traditional 401(k) contributions are made with pre-tax dollars - you don't pay federal taxes on contributions. The money grows and is tax-deferred until you begin to make withdrawals.

- Consider a Roth 401(k) if your employer offers it. Contributions are made with after-tax dollars, and you won't pay taxes when you withdraw during retirement. The Roth 401(k) works well for those in low tax brackets who will probably be in a higher tax bracket during retirement. There are contribution caps to both types of 401(k)s - $22,500 for those under 50 and $30,500 for people 50 and older.

- Use an employer match if they offer it.

- Increase your retirement contributions.

- Pay off debt. This is a significant one. Once debt is paid off, you can direct that money to retirement savings.

- Open an Individual Retirement Account (IRA). The IRA offers more investment options, including stocks, bonds, ETFs, and mutual funds. Contributions in 2023 were limited to $6,500 for those under 50 and $8,000 for 50 and older.

- Know your retirement needs.

- Don't touch your retirement savings.

Self-Directed IRAs, Alternative Investments

Of course, in addition to the traditional methods we've already covered, there are many ways to begin saving and investing for retirement. One time-tested avenue for increasing retirement savings is with a self-directed retirement account (SDIRA). The SDIRA offers great flexibility, access to a broader range of investments, and tax benefits.

Diversifying your retirement portfolio beyond traditional investments is a strategic way to reduce risk, increase stability, and potentially boost returns. Alternative assets have the potential to outperform traditional investments like stocks, bonds, and mutual funds. With their low correlation to the broader market, these assets can serve as a valuable buffer during economic downturns.

The self-directed IRA can offer an investor a variety of alternative investment choices, including real estate, heavy metals, cryptocurrency, clean energy, oil and gas, and agriculture. Another popular and viable option is Short Notes, in which investors purchase debt and the security instrument attached to that debt.

Connect Invest Short Notes provides high-yield, short-term real estate investment opportunities with annual returns of up to 9.0%. Our Short Note portfolio exclusively partially funds professionally vetted, first-position, collateral-backed projects across 14 states and 36 cities.

The Future is Yours to Be Had

While it's ideal to begin saving for retirement as early as possible, it's also never too late to start. You are destined to retire, so take stock of your current resources, work on paying off any debt, understand what you'll need, and develop some saving and investing strategies.

Remember that diversification is the strength of your retirement financial portfolio. In addition to traditional investments and savings, look at the alternatives. Connect Invest Short Notes are a highly accessible option to diversify your self-directed IRA portfolio. Investing in real estate this way lets you earn fixed-rate, passive income without the burdens of direct property ownership or management. Start today!